If you’re considering making a second application under the COVID-19 early release of super payment, there may be other options available that can help to cover your expenses now with a lower long-term impact.

Banking and finance sectors, in addition to the Federal Government, have introduced a number of financial relief packages to those impacted by the COVID-19 pandemic.

In this article, we’ll address what some of the alternative options are, depending on your circumstances, and why withdrawing from your super now can have a significant impact over the long-term.

Managing the financial impact of Covid-19

The magic of compound interest

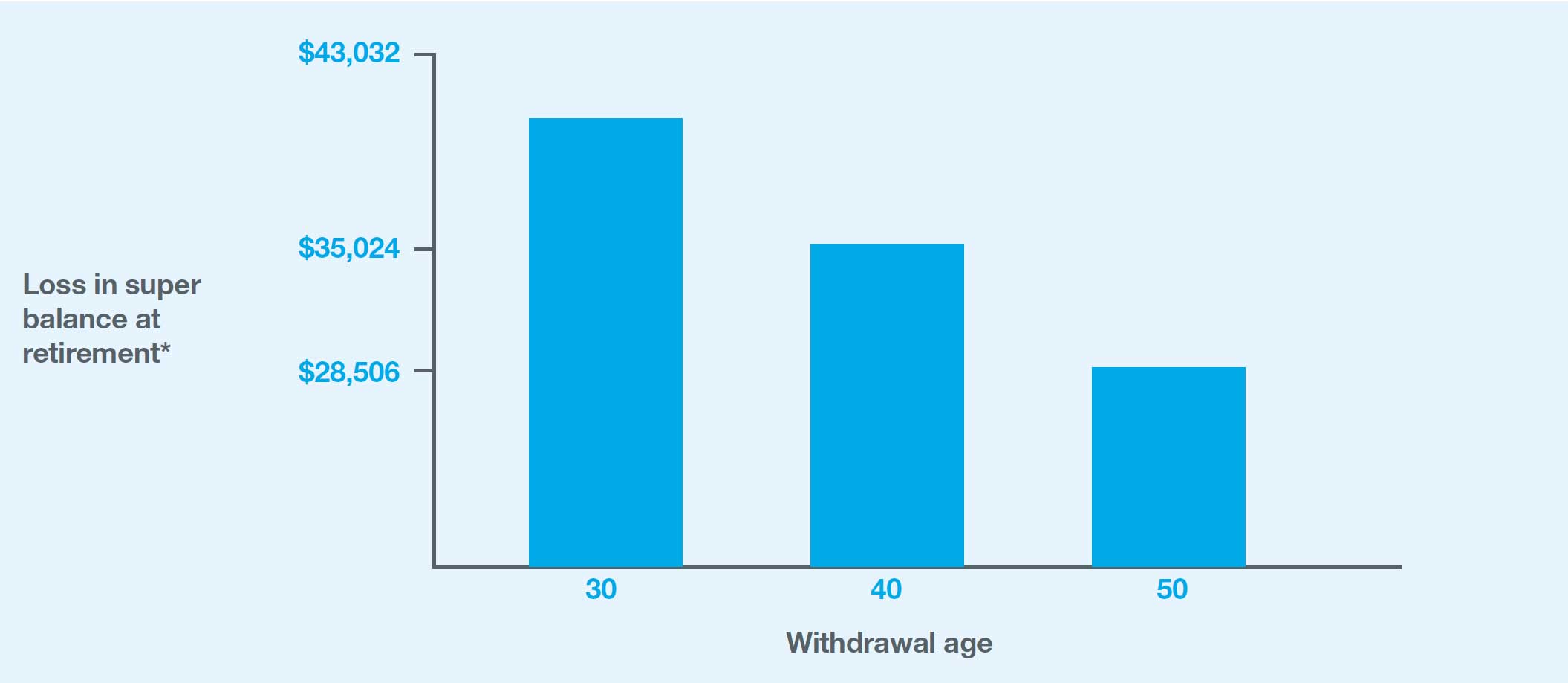

If you’ve already accessed $10,000 from your super as part of the first application, and are looking to take out another $10,000 in the second, this is what the reduction in your retirement savings could look like depending on your age.

These figures are based on the power of compounding returns which enables you to earn interest on interest accumulated over time.

Compounding returns are like planting a tree. When that tree grows, it produces seeds that allows you to plant other trees. Those trees will also grow and produce seeds of their own. So, with enough time, you could turn one tree into an entire forest.

Because the benefit of compounding returns is generally most effective over a long timeframe, in order to truly see its potential, the longer your money has time to grow, the better.

Selling your investments in a market downturn

If you decide to take out your super during a market downturn, it’s important to consider the impact it will have on the potential value of your investments.

For example, if your shares were worth $2 last year, but are now worth $1, you may be selling them for half their potential value - a bit like selling your home during a property slump.

Other potential financial relief benefits available

Depending on your situation, a number of sources of financial assistance have become available to help people deal with the impact of COVID-19.

Some of these may provide the same short-term financial relief as accessing your super, but with potentially less long-term impact to your retirement savings.

Financial and banking institutions

Some banks are now enabling customers to defer their loan repayments temporarily in addition to refunding late fees and interest for credit card payments.

It’s important to remember that while this option might help with your short-term cash flow, interest will continue to be charged to your outstanding loan amount - meaning more interest could be payable over the term of the loan.

It’s also worth checking with your bank to ensure these offers apply to you.

Federal Government’s economic response packages

The Government is supporting individuals and families affected by COVID-19 through a range of measures. Below we outline some which may benefit you.

1. JobKeeper Payment

Under the JobKeeper payment, businesses that meet certain criteria will be able to access a subsidy from the Government to help continue paying their employees. Eligible employers need to apply to the ATO for the payment on behalf on their employees.

By keeping employees ‘tied’ to their jobs, JobKeeper is designed to maintain employment. Typically getting people back into the workforce is one of the most difficult economic problems caused by recessions.

JobKeeper was due to cease on 27 September.

The Government has proposed to extend the JobKeeper program with the payment to be reduced over time and paid at two rates. The two rates relate to whether you’re considered to be a full-time or part-time worker for this purpose, and is intended to be determined based on the hours you worked in the applicable test period. Depending on your circumstances, this test period will be either February or June 2020. Full-time workers are those who have worked more than 20 hours in the applicable test period.

From 28 September 2020 to 3 January 2021:

- The payment rate will fall to $1,200 each fortnight for full-time employees, and

- $750 each fortnight for part-time employees.

From 4 January 2021 to 28 March 2021, the JobKeeper payment rate will be:

- $1,000 each fortnight for full-time employees.

- The rate for part-time employees will fall to $650 each fortnight over this period.

To find out more, including whether you’re an eligible employee, visit the Federal Government’s JobKeeper payment web page.

2. Income support for individuals

The Government has implemented a number of temporary measures to enable more people to access some social security benefits and concessions. This includes temporarily relaxing some of the eligibility criteria for certain payments.

The COVID-19 supplement also temporarily increases the total payments available to eligible social security recipients.

The Government has proposed to extend payment of the supplement to 31 December 2020 at a reduced rate of $250.

The supplement is taxable and is paid automatically to people receiving an eligible payment or benefit. The list of qualifying income payments is available here.

If you’re receiving JobKeeper payment from your employer, this must be declared as income if you’re applying for or receiving any payments or benefits.

You can register online via MyGov or by phone for social security payments and other concessions.

3. Economic support payments for pensioners

Two payments of $750 each were made to people receiving certain social security payments and eligible concession card holders.

The first payment was made from 31 March 2020 and the second payment was paid around 10 July 2020.

Importantly, these payments are not taxable and don’t count as income for the purposes of social security, Farm Household Allowance and veteran payments.

Contact Services Australia to discuss the full range of benefits and concessions that may apply to you.

4. Temporary reduction in minimum pension drawdown rates

The Government has also temporarily reduced minimum drawdown requirements for account-based pensions and some other super income streams by 50 percent for 2019-20 and 2020-21.

If you’re able to reduce your pension payments, this measure may mean you don’t need to sell investment assets to fund minimum drawdown requirements. It also provides your investments with the opportunity to recover from the recent market downturn.

5. Reducing social security deeming rates

When calculating your income for certain social security payments and benefits, the deeming rate is applied to determine the rate of return that the Government assumes your financial assets earn.

On 1 May 2020, the deeming rates were reduced by 0.75 percent, so if your entitlement is determined under the income test, this means you may start to receive an increased payment from Services Australia or the Department of Veterans Affairs. This increase will be calculated and paid automatically.

Alternatively, where you previously didn’t qualify because of the income test, you might now be eligible for a payment or concession.

How a financial adviser could help you

People often call on the expertise of financial advisers at especially stressful times in their lives, like what we’re currently experiencing now due to the COVID-19 pandemic.

Financial advisers can help with everything from budgeting, to loan management and consolidation to reduce repayments, as well as advising on whether accessing the Government’s early release of super may be a good idea for you. To speak with our Senior Financial Planners, call 1300 654 193 or email support@snowstarcu.com.

*These results have been generated using the ‘Super withdrawal estimator’ available on the ASIC MoneySmart website at https://moneysmart.gov.au/ covid-19/accessing-your-super. The estimates are based on assumptions including a retirement age of 67, a gross investment return of 7.5% pa, tax on earnings of 7%, investment fees of 0.85% pa, income of $50,000 and an initial inflation rate of 2.5% pa with a growth rate of 1.5% pa. All results are shown in today’s dollars. Additional assumptions are outlined in the ‘Super withdrawal estimator’. The above table is provided for illustrative purposes only and is not specific to the fees and costs of a particular financial product. Investment returns are not guaranteed.

Important information and disclaimer

This article has been reproduced with permission of MLC Investments Limited (ABN 30 002641 661, AFSL 230705) (MLC), a member of the National Australia Bank Limited (ABN 12 004 044 937, AFSL 230 686) group of companies (NAB Group), 105-153 Miller Street North Sydney 2060. Any advice in this publication is of a general nature only and has not been tailored to your personal circumstances. Accordingly, reliance should not be placed on the information contained in this article as the basis for making any financial investment, insurance or other decision. Please seek personal advice prior to acting on this information. Information in this publication is accurate as at the date of writing (August 2020). In some cases the information has been provided to us by third parties. While it is believed the information is accurate and reliable, the accuracy of that information is not guaranteed in any way. Opinions constitute our judgement at the time of issue and are subject to change. Neither Snow Star Credit Union, the Licensee nor any member of the NAB Group, nor their employees or directors give any warranty of accuracy, or accept any responsibility for errors or omissions in this article. Any general tax information provided in this publication is intended as a guide only and is based on our general understanding of taxation laws. It is not intended to be a substitute for specialised taxation advice or an assessment of your liabilities, obligations or claim entitlements that arise, or could arise, under taxation law, and we recommend you consult with a registered tax agent.